Sustainability issues such as climate change, labor rights, public health – are important drivers of investment value. Asset owners – particularly large pension funds and sovereign wealth funds – play a key role in providing the capital that supports national economic and development goals and are essential in building the conditions for the widespread adoption of sustainable investment. These are compelling reasons for asset owners to adopt sustainable investment, and for governments to support them in these endeavors.

Better disclosure (or transparency) by asset owners is an important mechanism for driving sustainability in investment markets and in the wider economy. While the general case for asset owner disclosure is clear, it is not clear what disclosures asset owners should provide or what information would be most useful to their stakeholders who include governments, asset managers, companies and civil society.

A new report, Sustainable Investment: Best Practice Disclosure Checklist for Pension Funds, part of our work embedding sustainability practices into institutional investor practices, attempts to addresses this challenge. This report provides a comprehensive checklist of the disclosures that asset owners’ stakeholders are likely to be interested in. The checklist was tested on some of the world’s largest pension funds and the subsequent analysis has provided some interesting insights into how these funds – many of whom are regarded as leaders on sustainable investment – are currently reporting on their approach to sustainable investment.

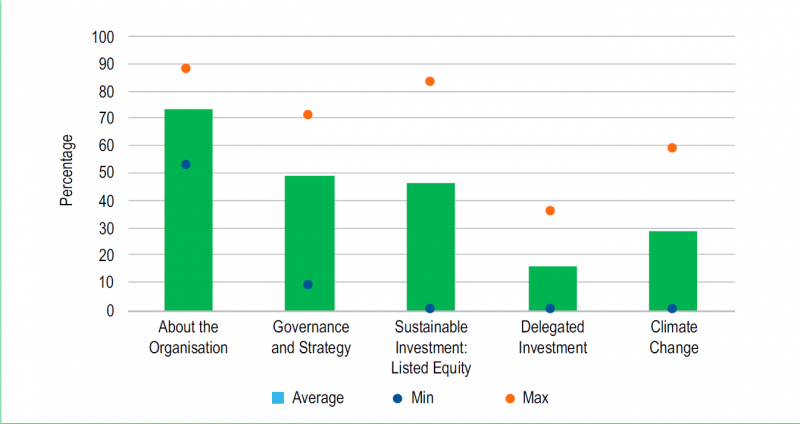

As can be seen in the summary table below, all the funds, including those that have not made commitments to sustainable investment, provide extensive disclosures about their organization, their mandates and their governance. The lower average score by some funds can be explained by the fact that they have only recently started to develop their sustainable investment objectives and strategies, and their disclosures are correspondingly lagging.

The report also found that the disclosures about the funds` organizational approach to sustainable investment are not matched by the disclosures they provide about implementation of their sustainable investment commitments, e.g. how these commitments are implemented in listed equities, in delegated (outsourced) investment management or in the specific case of climate change.

Average Percentage of Benchmark Indicators by Category Reported by Funds

The report helps identify a series of best practice examples that might be of interest to other pension funds as they start on their reporting journey. The report also includes insights and examples relevant to both developed and emerging market pension funds. The framework is already being used by the World Bank Group team to guide regulatory and policy advice in client countries.