What is Wealth Accounting?

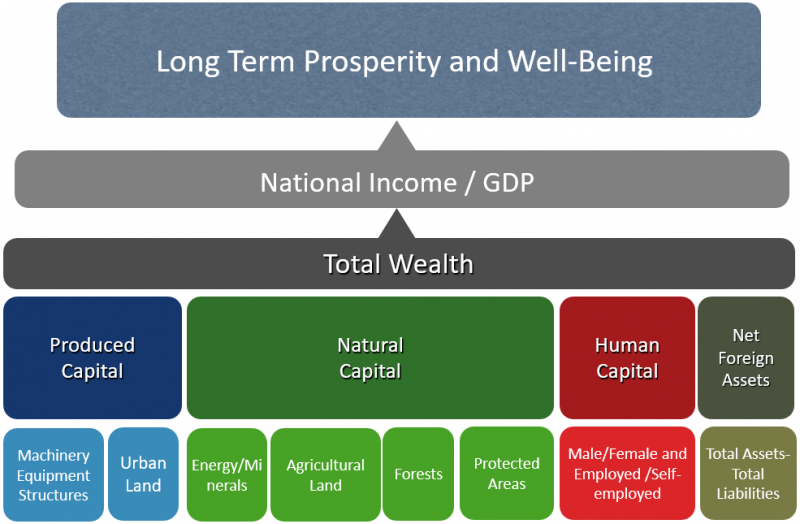

Wealth is what underpins the income that a country generates. It includes produced capital (buildings, the machinery used in factories, infrastructure like highways and ports, etc.), natural capital (including land, forests, fish, minerals and energy), human capital, and net foreign assets. Wealth accounting is a methodology for measuring these assets

There is some provision for wealth accounting under the System of National Accounts (SNA), which provides an international standard for measuring national income and savings and is followed by all countries. However, relatively few countries currently carry out wealth accounting. This means they have a very incomplete picture of their prospects for future income, just as assessing the value of a business would be incomplete without analyzing its balance sheet.

Truly comprehensive wealth accounting would go beyond the SNA to include broader forms of wealth such as human capital and the benefits flowing from ecosystem services, such as pollination and flood protection from mangroves.

Why is GDP not enough as an indicator?

Countries rely on GDP (gross domestic product) as a measure of economic performance. However, GDP only measures current income and production, telling us nothing about income for the long term, or the assets that underpin income. For example, when a country exploits its minerals, it is actually depleting wealth but that depletion is not captured by GDP. It also does not answer questions like: are income and growth sustainable? Will the same level of income be available for our children?

How can wealth accounting help countries grow sustainably?

Comprehensive wealth accounting can provide an estimate of the total wealth of nations by measuring the value of different components of wealth. Changes in wealth is an indicator to assess if a country is growing its income without depleting its stocks. (See Figure 1 below.)

Figure 1. Total wealth composition

How is Wealth Accounting Related to WAVES?

Natural capital is especially important to many developing countries because it forms a large share of their total wealth – 47% for low income countries. Natural capital accounting (NCA) focuses on this critical component of wealth.

In February 2012, the UN Statistical Commission (UNSC) approved the System of Environmental and Economic Accounts (SEEA) as an international statistical standard, like the SNA. The SEEA provides methodology for compiling accounts for material natural resources like minerals, water, energy and timber, as well as the emission of pollutants like greenhouse gases. It covers asset accounts and flow accounts, both monetary and physical. Methodology for ecosystem accounting, or for regulating services of ecosystems, is still being developed. The adoption of the SEEA is a fundamental leap forward: by providing crucial information to manage natural resources, NCA can be a powerful tool for policy makers grappling with trade-offs in a growing economy.

The Changing Wealth of Nations 2021 is the latest in a series that introduces the concept of wealth as a complementary indicator to GDP. The report tracks the wealth of 146 countries between 1995 and 2018, by measuring the economic value of renewable natural capital (such as forests, cropland, and ocean resources), nonrenewable natural capital (such as minerals and fossil fuels), human capital (earnings over a person’s lifetime), produced capital (such as buildings and infrastructure), and net foreign assets. By looking at all of these assets that underpin national income, wealth accounting provides a means to track the sustainability of economic progress into the future.

The report has made strides in how to measure national wealth since the previous edition in 2018. This includes adding measures for blue natural capital, like marine fisheries and mangroves, as well as increased number of countries covered, making this the most comprehensive wealth accounts available. And for the first time, the report examines the projected impact of future risks such as climate change and the low-carbon transition.

The WAVES Partnership is working with ministries of planning, development and finance across the world to integrate natural resources into development planning through NCA.

Figure 2. Natural capital: Share versus per capita value