Natural capital accounting (NCA) has gained prominence on the global sustainability agenda with governments, businesses and financial institutions coalescing on the view that natural resources, such as water and forests and the ecosystem services they provide, play a crucial role in the wealth of nations, companies' bottom lines, and financial risk management.

For the first time, all three groups came together at a two-day event, “Advancing Natural Capital Accounting in Government, Business, and Finance: Theory, Practice and Enabling Conditions,” April 8-9, 2015, to share views, align definitions and approaches, build consensus, and establish priorities to work in tandem. There was agreement to create a community of practice aimed at developing collaborative approaches to scale-up the application of NCA.

The event was organized by a task force that came together in January involving a broad range of experts and practitioners. The task force members are Globe International, the International Union for Conservation of Nature (IUCN), the Natural Capital Coalition (NCC), the Natural Capital Declaration (NCD), The Economics of Ecosystems and Biodiversity/United Nations Environment Programme, and the World Bank Group. Each of the members represents a wide range of interested parties already dealing with natural capital in some way and serve as a means to connect to a much wider constituency.

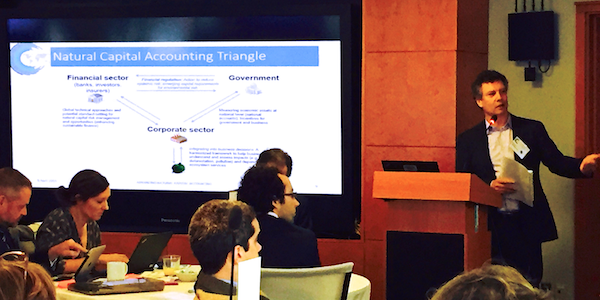

Representatives from the three corners of the NCA Triangle: government, business, and finance, discussed the role of natural capital during a panel discussion on developments in the three sectors and the landscape of existing collaboration and links between initiatives. Participants agreed that the "public" or consumer, is an important element in the equation. Read more

Representatives from the three corners of the NCA Triangle: government, business, and finance, discussed the role of natural capital during a panel discussion on developments in the three sectors and the landscape of existing collaboration and links between initiatives. Participants agreed that the "public" or consumer, is an important element in the equation. Read more

Sixty experts attended the event from governments, multilateral bodies, leading companies and financial institutions, conservation organizations, academia, and international initiatives and NGOs. Participants included representatives from companies such as Shell and Nestlé-Nespresso; National Australia Bank and Banorte from the financial sector; donor governments supporting NCA initiatives such as Italy, the Netherlands, Norway and Switzerland; participants from the World Bank Group; and from NGOs such as WWF, TNC, Conservation International and the Scottish Wildlife Trust.

“We are here at a key moment in the development of NCA, and the impact it can have on the sustainability of economic activity. It is with a great sense of urgency that we meet to align our efforts, and create impacts that are greater than those we can have alone,” said Frank Hawkins, Director of the International Union for Conservation of Nature (IUCN) office in Washington, DC and the event’s moderator.

Paula Caballero, Senior Director of the World Bank Group’s Environment and Natural Resources Global Practice, delivered the keynote speech, offering the group “absolute full support” from the World Bank. “We need to take concrete next steps so we can really catalyze this platform to take us forward very, very quickly. You have a unique opportunity to take things to scale: the clout, the leveraging, the decision-making that is unique.”

Caballero said NCA has moved the conversation from natural capital being an invisible asset to a national asset, and is providing the big picture of the broad view of development and the trade-offs between different sectors. She pointed to the success of the Wealth Accounting and the Valuation of Ecosystem Services (WAVES) partnership, which is “starting to pay dividends, and becoming the day to day work of planning and development ministries.”

Governments, business, and the finance sector have been separately developing global initiatives and methodologies for some years, and their emerging approaches are being tested by each of their constituencies. The concept behind the meeting is that in order for NCA to ramp up and take hold across all three sectors it needs to be applied on a larger scale.

“Having all three sectors at the table: the public sector, financial sector, and the corporates, is important to put together workable solutions,” said Bill Rahill, Director of the World Bank Group’s Environment and Natural Resource Global Practice.

Participants agreed it is also essential to leverage the expertise of other stakeholders including academia, civil society, and the non-profit sector, and to create a narrative that works well with finance ministries, businesses and the financial sectors.

Suggestions to facilitate a more widespread uptake of natural capital accounting include: the availability of accurate, easy-to-find data; harmonizing approaches and methodologies; transparency in information sharing; having a natural capital data-entry point besides GDP; and far-reaching geographical representation.

Martin Lok, Program Manager Natural Capital at the Dutch Ministry of Economic Affairs, spoke on a panel about the “three corners of the natural capital triangle.” He said the Netherlands is working to incorporate natural capital in all decision-making and systems of businesses, governments and the financial sector. “(The Ministry of Economic Affairs) was asked to bring the three constituencies around the table because they encounter the same problems when they want to put natural capital into their core business.”

Lok suggests three things: a joint storyline why natural capital is at stake for government, business, and banks; the rights tools and methods to make measurement easy using the same kind of data; and an enabling environment with policies that promote the uptake of natural capital.

Next Steps

As a result of this first group exchange between constituencies, participants agreed in the short term to find a platform to share information and include a wider group of people, continue the momentum amongst their sectors, and feed the lessons learned into several major events, including the WAVES 5th Annual Partnership Meeting in June and the World Forum on Natural Capital that will take place in Edinburgh, Scotland in November.